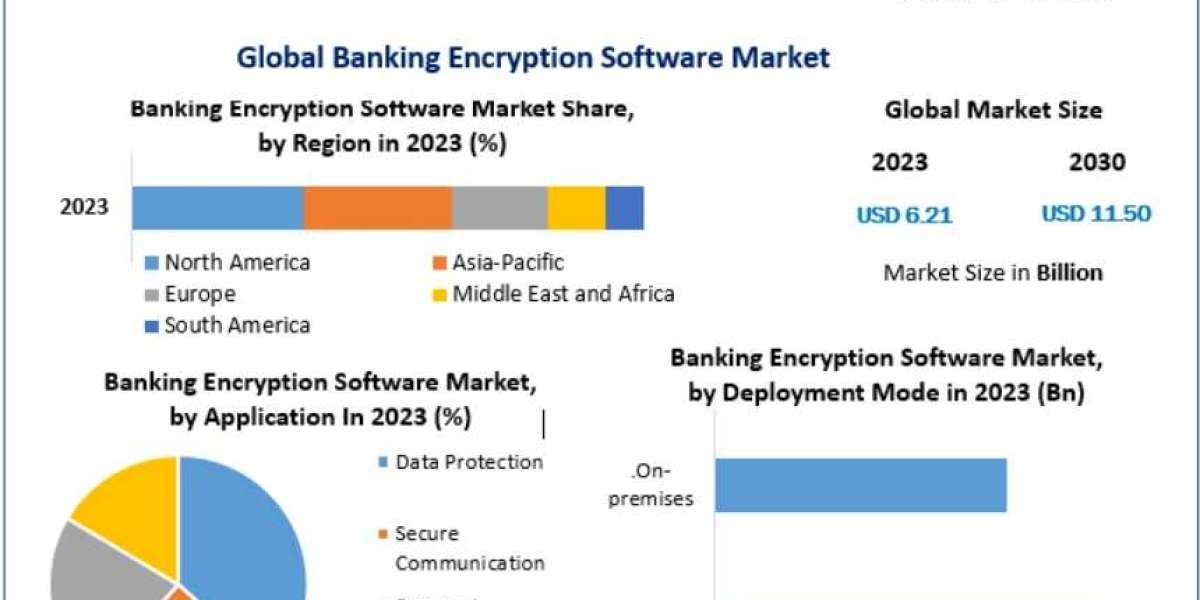

Global Banking Encryption Software Market to Reach USD 11.50 Billion by 2030, Growing at a 9.2% CAGR

The Global Banking Encryption Software Market is set for strong growth, projected to reach USD 11.50 billion by 2030, expanding at a CAGR of 9.2% from 2024 to 2030. This growth reflects the rising importance of safeguarding sensitive financial data in an increasingly digital banking ecosystem.

Market Overview

Banking encryption software includes technologies designed to protect confidential financial information, secure transactions, and prevent unauthorized access. With online and mobile banking, electronic payments, and cloud services becoming central to financial operations, the need for robust encryption measures has intensified.

The industry is being driven by stringent regulatory requirements, increasing cyber threats, and the digitization of financial services. Encryption solutions today offer functions like secure key management, tokenization, secure file sharing, and encrypted communications, ensuring confidentiality, integrity, and regulatory compliance.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/189648/

Key Market Dynamics

Drivers

Rising cyberattacks on financial institutions: Increasingly sophisticated hacking techniques have accelerated demand for encryption solutions.

Regulatory pressure: Compliance with FINRA, PCI DSS, and GDPR mandates robust data protection practices.

Digitization of financial services: Online and mobile banking expansion has created new vulnerabilities, prompting banks to secure data at rest and in transit.

Opportunities

Blockchain adoption: Integrating encryption with blockchain enhances secure and transparent transactions.

Open banking: Encryption safeguards APIs and third-party integrations.

Cloud-based services: As banks migrate operations to the cloud, secure cloud encryption is becoming essential.

Restraints

High implementation costs: Integration with legacy banking systems is complex and expensive.

User experience trade-offs: Enhanced encryption may cause delays or add authentication steps, impacting convenience.

Challenges

Evolving cyber threats: Encryption vendors must continuously innovate to stay ahead of attackers.

Lack of awareness: Both banking professionals and customers need better education on the role of encryption in safeguarding financial assets.

Emerging Trends

Cloud-based encryption solutions are increasingly adopted to secure flexible, scalable banking operations.

AI and machine learning integration enhances real-time threat detection and automated response.

Biometric authentication strengthens identity verification when paired with encryption.

Blockchain-based encryption promises secure, immutable, and transparent transactions.

Segment Analysis

By Deployment: On-premises, cloud-based, and hybrid models.

By Encryption Type: Symmetric, asymmetric, and hashing algorithms.

By Application: Data protection, secure communication, payment encryption, and digital identity management.

By End-User: Retail banks, commercial banks, investment banks, and other financial institutions.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/189648/

Regional Insights

North America: Leads the market with strong banking infrastructure and strict regulations.

Europe: Mature market with GDPR driving adoption.

Asia-Pacific: Fastest growth due to rapid digitization, expanding banking services, and heightened cyber risks in China, India, and Japan.

Latin America: Growing digital payments and e-commerce driving adoption in Brazil, Mexico, and Argentina.

Middle East & Africa: Rising banking investments and cybersecurity initiatives boosting demand.

Competitive Landscape

The market is moderately concentrated, with key players like:

North America: Microsoft, Cisco, McAfee, Symantec

Europe: Thales, Gemalto, Kaspersky, Check Point

Asia-Pacific: Trend Micro, Huawei, Infosec Global

Latin America : Kryptus, Sequrit, Axur

Middle East & Africa: BeyondTrust, Help AG, BioCatch

These firms compete on innovation, integration ease, scalability, and customer support. Emerging players targeting niche solutions further enhance market competition.

Market Outlook

With increasing digitization, evolving regulatory frameworks, and the relentless rise of cybercrime, the banking encryption software market is positioned for sustained growth. Vendors that innovate in cloud security, blockchain integration, and AI-powered encryption will gain a competitive advantage in shaping the secure financial ecosystem of the future.