"Detailed Analysis of Executive Summary Europe Digital Lending Platform Market Size and Share

CAGR Value

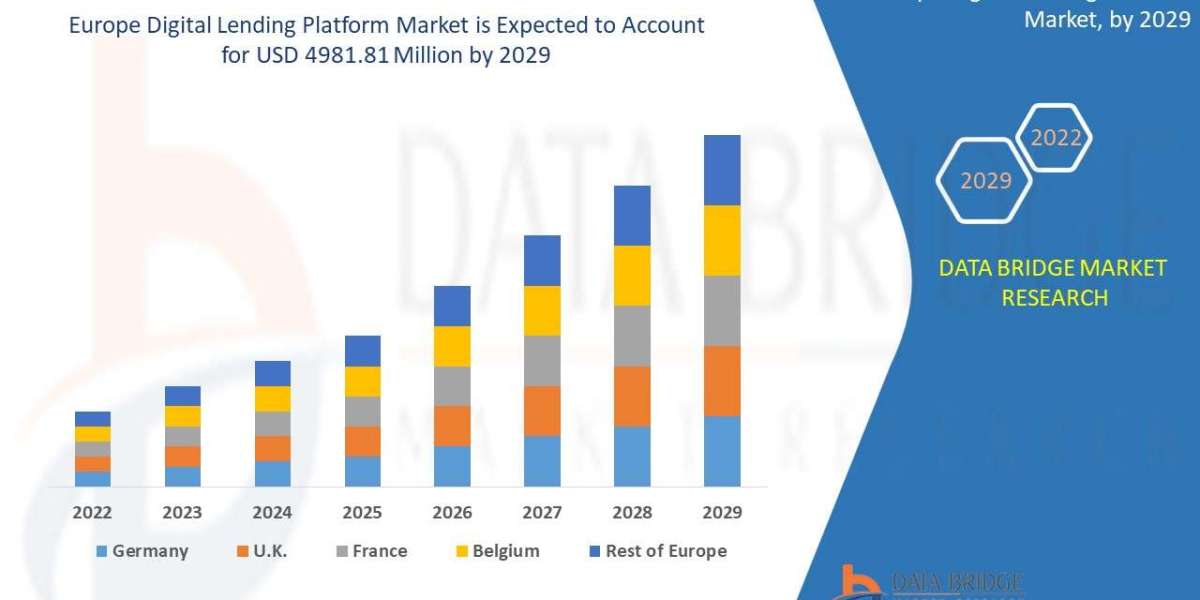

Europe digital lending platform market was valued at USD 1238.83 million in 2021 and is expected to reach USD 4981.81 million by 2029, registering a CAGR of 19.00% during the forecast period of 2022-2029.

This Europe Digital Lending Platform Market report serves you with the bigger picture of the marketplace as it studies market and the industry by considering several aspects. This market report gives an absolute background analysis of the industry along with an assessment of the parental market. To achieve sustainable growth in the market, businesses must be well-versed with the specific and most relevant product and market information in the Europe Digital Lending Platform Market The resources used for collecting the data and information that is included in this report are very trustworthy and range from journals, company websites, and white papers etc.

Being professional and comprehensive, this Europe Digital Lending Platform Market report focuses on primary and secondary drivers, market share, leading segments, possible sales volume, and geographical analysis. This market report also analyzes the market status, market share, current trends, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors. The Europe Digital Lending Platform Market report clearly explains what market definition, classifications, applications, engagements and market trends are for the Europe Digital Lending Platform Market industry. This market report provides explanation about the detailed market analysis with inputs from industry experts. The Europe Digital Lending Platform Market report presents data on patterns and improvements, and target business sectors and materials, limits and advancements.

Take a deep dive into the current and future state of the Europe Digital Lending Platform Market. Access the report:

https://www.databridgemarketresearch.com/reports/europe-digital-lending-platform-market

Europe Digital Lending Platform Market Data Summary

**Segments**

- **By Component**: The Europe digital lending platform market can be segmented by component into software and services. The software segment is expected to dominate the market due to the increasing adoption of digital lending solutions by financial institutions to streamline their lending processes. Digital lending software provides features such as loan origination, underwriting, and servicing, which help in automating the loan approval process and reducing operational costs. On the other hand, the services segment is also witnessing significant growth as organizations are increasingly outsourcing their digital lending operations to third-party service providers to focus on their core business activities.

- **By Deployment Type**: Based on deployment type, the market can be categorized into cloud and on-premises deployment. The cloud deployment segment is anticipated to exhibit substantial growth during the forecast period. Cloud-based digital lending platforms offer benefits such as scalability, flexibility, and cost-efficiency, which are driving their adoption among financial institutions. Additionally, cloud deployment enables easy access to data and applications from anywhere, making it a preferred choice for organizations looking to enhance their lending operations.

- **By End-User**: In terms of end-users, the Europe digital lending platform market can be segmented into banks, credit unions, and peer-to-peer lending platforms. Among these, banks are expected to hold a significant market share owing to their large customer base and extensive lending portfolios. Digital lending platforms help banks in offering personalized loan products, streamlining the loan approval process, and improving customer experience. Credit unions and peer-to-peer lending platforms are also increasingly adopting digital lending solutions to stay competitive in the market and attract a wider customer base.

**Market Players**

- **Upstart Network Inc.**: Upstart Network Inc. is a prominent player in the Europe digital lending platform market known for its AI-powered lending platform that enables banks and other financial institutions to make faster and more accurate lending decisions. The company's platform leverages machine learning algorithms to assess borrower risk and provide instant loan approval, thereby enhancing the overall lending experience.

- **LendingClub Corporation**: LendingClub Corporation is another key player offering digital lending solutions in the European market. The company's platform connects borrowers with investors through an online marketplace, providing access to personal loans, business loans, and auto refinancing options. LendingClub's platform incorporates data analytics and automation tools to simplify the lending process and improve loan approval rates.

- **Blend Labs, Inc.**: Blend Labs, Inc. is a leading provider of digital lending platforms that enable financial institutions to offer a seamless borrowing experience to customers. The company's platform integrates with various data sources to gather borrower information, assess credit risk, and facilitate faster loan approvals. Blend's digital lending solutions help financial institutions in optimizing their lending operations and driving customer satisfaction.

The Europe digital lending platform market is witnessing substantial growth due to the increasing digitization of financial services and the growing demand for efficient lending solutions. Factors such as the rise in online lending platforms, the adoption of advanced technologies like AI and machine learning, and the shift towards paperless loan processes are driving the market expansion. Financial institutions are increasingly investing in digital lending platforms to streamline their operations, reduce time-to-market for new loan products, and enhance customer experience. Overall, the market is poised for significant growth in the coming years as organizations continue to embrace digital transformation in the lending sector.

The Europe digital lending platform market is experiencing a profound transformation driven by the increasing need for streamlined and efficient lending processes. One key trend shaping the market is the integration of advanced technologies like artificial intelligence and machine learning into digital lending platforms. These technologies are empowering financial institutions to make faster and more accurate lending decisions by assessing borrower risk more effectively and providing instant loan approvals. Moreover, the adoption of cloud-based deployment for digital lending platforms is gaining traction due to its scalability, flexibility, and cost-efficiency benefits. Cloud deployment enables easy access to data and applications from anywhere, catering to the evolving needs of financial institutions looking to enhance their lending operations.

In terms of market players, Upstart Network Inc., LendingClub Corporation, and Blend Labs, Inc. stand out as prominent providers of digital lending solutions in Europe. Upstart Network's AI-powered lending platform is revolutionizing lending processes by leveraging machine learning algorithms to streamline decision-making and enhance the overall borrower experience. LendingClub's online marketplace connects borrowers with investors, offering a wide range of loan options and simplifying the lending process through data analytics and automation tools. Blend Labs focuses on providing seamless borrowing experiences for customers through its digital lending platforms, which optimize lending operations and drive customer satisfaction for financial institutions.

The market is also witnessing a shift towards personalized loan products offered by banks, which are a significant end-user segment in the Europe digital lending platform market. Banks leverage digital lending solutions to enhance customer experience, improve loan approval processes, and cater to their extensive lending portfolios. Credit unions and peer-to-peer lending platforms are also embracing digital lending technologies to remain competitive in the evolving market landscape and attract a broader customer base. This diversification in end-users reflects the growing adoption of digital lending platforms across various financial institutions to meet the changing demands of borrowers and improve operational efficiencies.

Overall, the Europe digital lending platform market is poised for continued growth as organizations continue to invest in digital transformation initiatives within the lending sector. The market's expansion is fueled by the increasing digitization of financial services, the rising popularity of online lending platforms, and the ongoing integration of innovative technologies. With a focus on enhancing operational efficiency, reducing time-to-market for new loan products, and delivering exceptional customer experiences, digital lending platforms are reshaping the way financial institutions engage with borrowers and drive business growth in the digital era.The Europe digital lending platform market is undergoing a significant transformation driven by the increasing adoption of advanced technologies such as artificial intelligence and machine learning. These technologies are empowering financial institutions to streamline their lending processes, make more informed decisions, and provide a seamless borrowing experience to customers. The integration of AI and machine learning algorithms in digital lending platforms is revolutionizing how risk assessment is conducted, leading to faster loan approvals and improved customer satisfaction. This trend is expected to continue shaping the market dynamics as organizations prioritize efficiency, accuracy, and innovation in their lending operations.

Cloud deployment is emerging as a preferred choice for financial institutions in Europe looking to enhance their lending operations. Cloud-based digital lending platforms offer scalability, flexibility, and cost-efficiency benefits, enabling organizations to access data and applications from anywhere. This trend is driven by the need for agility and accessibility in today's digital environment, where organizations seek to optimize their operations and meet evolving customer demands effectively. As more financial institutions migrate towards cloud-based deployment models, the Europe digital lending platform market is poised for continued growth and expansion.

Market players such as Upstart Network Inc., LendingClub Corporation, and Blend Labs, Inc. are playing a significant role in driving innovation and competitiveness in the Europe digital lending platform market. These key providers offer cutting-edge solutions that leverage data analytics, automation tools, and seamless integration to enhance the loan approval process, improve operational efficiencies, and deliver exceptional customer experiences. By focusing on customer-centric approaches and technological advancements, these market players are setting new standards for digital lending platforms in Europe and reinforcing the importance of innovation in the financial services industry.

Furthermore, the market is witnessing a trend towards personalized loan products offered by banks, which are leveraging digital lending solutions to cater to their extensive customer base and diverse lending portfolios. Credit unions and peer-to-peer lending platforms are also leveraging digital lending technologies to expand their market reach, remain competitive, and attract a broader customer base. This diversification of end-users underscores the growing adoption of digital lending platforms across various financial institutions, signaling a shift towards digitally-driven lending processes that prioritize efficiency, customer satisfaction, and operational excellence.

Overall, the Europe digital lending platform market is poised for sustained growth as organizations continue to invest in digital transformation initiatives and embrace the latest advancements in technology. With a strong emphasis on innovation, efficiency, and customer-centricity, digital lending platforms are reshaping the financial services landscape in Europe and redefining the way lending operations are conducted in the digital age. As the market evolves, market players and end-users alike are expected to drive further advancements and enhancements that will continue to propel the growth of the digital lending platform market in Europe.

Investigate the company’s industry share in depth

https://www.databridgemarketresearch.com/reports/europe-digital-lending-platform-market/companies

Europe Digital Lending Platform Market Overview: Strategic Questions for Analysis

- What is the size of the global Europe Digital Lending Platform Market industry this year?

- What rate of growth is forecasted for the next decade for Europe Digital Lending Platform Market?

- What are the key divisions of the Europe Digital Lending Platform Market?

- Which organizations have the strongest presence in Europe Digital Lending Platform Market?

- Which markets are the focus of the geographic analysis for Europe Digital Lending Platform Market ?

- What companies are featured in the competitive landscape for Europe Digital Lending Platform Market?

Browse More Reports:

Global Hospital Workforce Management Software Market

Global Household Clothes Steamers and Dryers Market

Global Hunting Apparel Market

Global Hyaluronidase Deficiency Market

Global Hydrazine Hydrate Market

Global Hydrocephalus Treatment Market

Global Hygiene Adhesives Market

Global Hypertrophic Cardiomyopathy Treatment Market

Global Implantable Cardioverter Defibrillators (ICDs) Market

Global Indian Ginseng Market

Global Industrial Oils Market

Global Industrial Radiography Market

Global Infant Vitamin Supplements Market

Global Infused Fruits Jellies Market

Global In-Station Passenger Information System Market

U.S. Internal Neuromodulation Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"