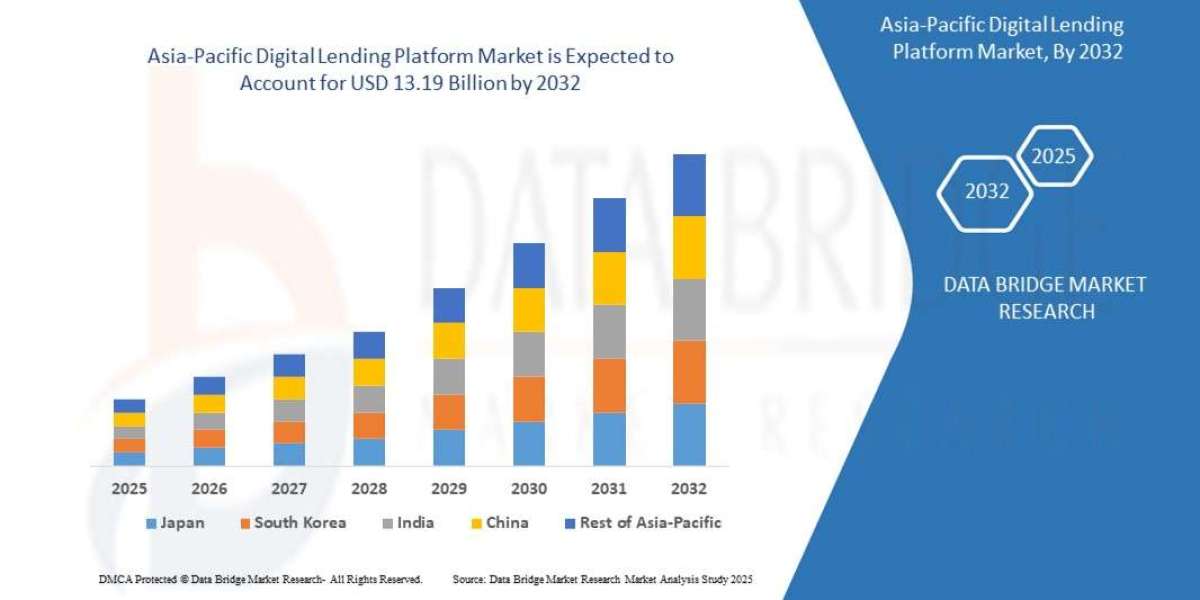

"Market Trends Shaping Executive Summary Asia-Pacific Digital Lending Platform Market Size and Share

CAGR Value

The Asia-Pacific digital lending platform market size was valued at USD 3.01 billion in 2024 and is expected to reach USD 13.19 billion by 2032, at a CAGR of 20.3% during the forecast period

The Asia-Pacific Digital Lending Platform Market report puts light on the change in the market which is taking place due to the moves of key players and brands such as product launches, joint ventures, mergers and acquisitions that in turn modifies the view of the global face of Asia-Pacific Digital Lending Platform Market industry. This market report takes into account myriad of aspects of the market analysis which today’s businesses call for. To make the report outstanding, most up-to-date and advanced tools and techniques are used so that client achieves maximum benefits. The Asia-Pacific Digital Lending Platform Market report also includes the market drivers and market restraints that are derived from SWOT analysis.

This Asia-Pacific Digital Lending Platform Market report helps businesses thrive in the market by providing them with a lot of insights about the market and the Asia-Pacific Digital Lending Platform Market industry. The key factors here include industry outlook with respect to critical success factors (CSFs), industry dynamics that mainly covers drivers and restraints, market segmentation & value chain analysis, key opportunities, application and technology outlook, regional or geographical insight, country-level analysis, key company profiles, competitive landscape, and company market share analysis. Thus, Asia-Pacific Digital Lending Platform Market research report is very important in many ways to grow your business and to be successful.

Unlock detailed insights into the growth path of the Asia-Pacific Digital Lending Platform Market. Download full report here:

https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market

Asia-Pacific Digital Lending Platform Industry Performance Overview

**Segments**

- **By Component**

- Software

- Services

- **By Deployment**

- Cloud

- On-Premises

- **By End-User**

- Banks

- Credit Unions

- Financial Institutions

- Insurance Companies

- others

- **By Country**

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Malaysia

- Thailand

- Indonesia

- Philippines

- Rest of Asia-Pacific

The Asia-Pacific digital lending platform market is segmented based on components, deployment, end-users, and countries. In terms of components, the market is divided into software and services. The deployment segment includes cloud and on-premises solutions. Furthermore, the end-users of digital lending platforms in the Asia-Pacific region consist of banks, credit unions, financial institutions, insurance companies, among others. Geographically, the market is analyzed across key countries such as China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific.

**Market Players**

- Upstart Network

- SoFi

- LendingClub Corporation

- Zopa Limited

- Prosper Marketplace, Inc.

The Asia-Pacific digital lending platform market features a competitive landscape with key players such as Upstart Network, SoFi, LendingClub Corporation, Zopa Limited, and Prosper Marketplace, Inc. These market players are actively involved in the development and implementation of digital lending solutions catering to the diverse needs of financial institutions and other end-users in the region. By offering innovative technologies and services, these players are driving the growth of the digital lending platform market in Asia-Pacific.

The Asia-Pacific digital lending platform market is witnessing substantial growth due to the increasing adoption of digital solutions across the financial sector in the region. With the components segment comprising software and services, market players are focusing on offering comprehensive solutions that enhance the lending processes for financial institutions and cater to the evolving needs of end-users. The software component includes platforms that facilitate online loan origination, underwriting, and management, while services encompass consulting, implementation, and support services for seamless integration and operation of digital lending platforms.

In terms of deployment, both cloud-based and on-premises solutions are in demand in the Asia-Pacific region. Cloud deployment offers scalability, flexibility, and cost-effectiveness, making it a preferred choice for organizations looking to streamline their lending operations. On-premises solutions cater to entities requiring greater control over their data and operations, especially in highly regulated industries like banking and insurance.

The end-user segmentation of the Asia-Pacific digital lending platform market highlights the diverse range of institutions leveraging these solutions. Banks and credit unions are early adopters, recognizing the efficiency and convenience digital platforms bring to the lending process. Financial institutions, including non-banking financial companies (NBFCs) and peer-to-peer lending platforms, are also embracing digital lending to expand their customer base and improve risk management practices. Insurance companies are exploring digital lending as a means to offer personalized financing options to policyholders, creating new revenue streams.

From a geographical perspective, countries such as China, Japan, India, and South Korea are experiencing significant growth in the digital lending platform market due to rapid technological advancements and supportive regulatory frameworks. Australia, Singapore, Malaysia, Thailand, Indonesia, and the Philippines are also emerging as key markets for digital lending solutions, driven by the increasing digitalization of financial services and the growing demand for efficient lending processes in these countries.

Overall, market players like Upstart Network, SoFi, LendingClub Corporation, Zopa Limited, and Prosper Marketplace, Inc. are at the forefront of innovation, continuously enhancing their platforms to meet the dynamic requirements of the Asia-Pacific digital lending landscape. By focusing on customer-centric solutions, advanced analytics, and secure infrastructure, these players are playing a pivotal role in driving the evolution of digital lending in the region, setting the stage for sustained growth and transformation in the financial services industry.One notable trend in the Asia-Pacific digital lending platform market is the increasing emphasis on data security and compliance. As financial institutions and other end-users adopt digital lending solutions, the protection of sensitive customer data and adherence to regulatory standards become paramount. Market players are investing in robust cybersecurity measures and compliance frameworks to ensure the integrity and confidentiality of data on their platforms. This focus on security not only helps build trust with users but also aids in maintaining regulatory compliance, which is crucial in highly regulated sectors such as banking and insurance.

Additionally, the integration of artificial intelligence (AI) and machine learning algorithms in digital lending platforms is gaining traction in the Asia-Pacific region. These technologies enable automated decision-making, personalized loan offerings, and enhanced risk assessment processes. By leveraging AI capabilities, market players can streamline operations, reduce manual errors, and provide a more tailored lending experience to customers. The deployment of AI-powered chatbots and virtual assistants also improves customer engagement and support, leading to higher satisfaction levels and increased loyalty.

Another key development in the Asia-Pacific digital lending platform market is the collaboration between traditional financial institutions and fintech companies. Established banks, credit unions, and insurance companies are partnering with fintech providers to leverage their expertise in digital lending technologies and enhance their service offerings. These strategic alliances enable incumbents to accelerate their digital transformation initiatives, reach new customer segments, and stay competitive in a rapidly evolving market landscape. By combining traditional financial services with innovative digital solutions, these partnerships drive innovation and fuel growth in the digital lending sector across the Asia-Pacific region.

Moreover, the shift towards mobile-first lending experiences is reshaping the way customers interact with financial institutions in the Asia-Pacific market. As smartphone penetration and digital literacy rise in the region, there is a growing demand for mobile-centric lending platforms that offer convenience, accessibility, and user-friendly interfaces. Market players are investing in mobile optimization, responsive design, and seamless app experiences to cater to the preferences of tech-savvy consumers who seek instant access to loans and financial services on their mobile devices. The mobile-first approach not only improves customer acquisition and retention but also enables organizations to reach untapped markets and drive financial inclusion initiatives in the Asia-Pacific region.

In conclusion, the Asia-Pacific digital lending platform market is evolving rapidly, driven by factors such as data security, AI adoption, industry collaborations, and mobile-centric strategies. Market players that prioritize innovation, customer experience, and regulatory compliance are well-positioned to capitalize on the growing demand for digital lending solutions in the region. As technology continues to reshape the financial services landscape, the Asia-Pacific market presents lucrative opportunities for digital lending providers to expand their offerings, drive operational efficiency, and deliver value-added services to a diverse range of end-users across various industries.

Check out detailed stats on company market coverage

https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market/companies

In-Depth Market Research Questions for Asia-Pacific Digital Lending Platform Market Studies

- What revenue figures define the current Asia-Pacific Digital Lending Platform Market?

- What are the near-term and long-term growth rates expected in Asia-Pacific Digital Lending Platform Market?

- What are the dominant segments in the Asia-Pacific Digital Lending Platform Market overview?

- Which companies are covered in the competitor analysis for Asia-Pacific Digital Lending Platform Market?

- What countries are considered major contributors for Asia-Pacific Digital Lending Platform Market?

- Who are the high-growth players in the Asia-Pacific Digital Lending Platform Market?

Browse More Reports:

Global Integrated Quantum Optical Circuits Market

Global Interesterified Fats Market

Global Internet Protocol Television (IPTV) Market

Global Intraoperative Neurophysiological Monitoring Market

Global Intravenous Immunoglobulin Market

Global Isothermal Nucleic Acid Amplification Technology/INAAT Market

Global IVD Reagents Market

Global Jet Lag Therapy Treatment Market

Global Kernicterus Treatment Market

Global Kidney Disease Market

Global Kidney Function Tests Market

Global Kyphosis Treatment Market

Global Laboratory Informatics Market

Global Laboratory Mixer Market

Global Laminated Labels Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"