Global Cold Plasma Market – Industry Growth, Trends, and Forecast (2025–2032)

Market Overview

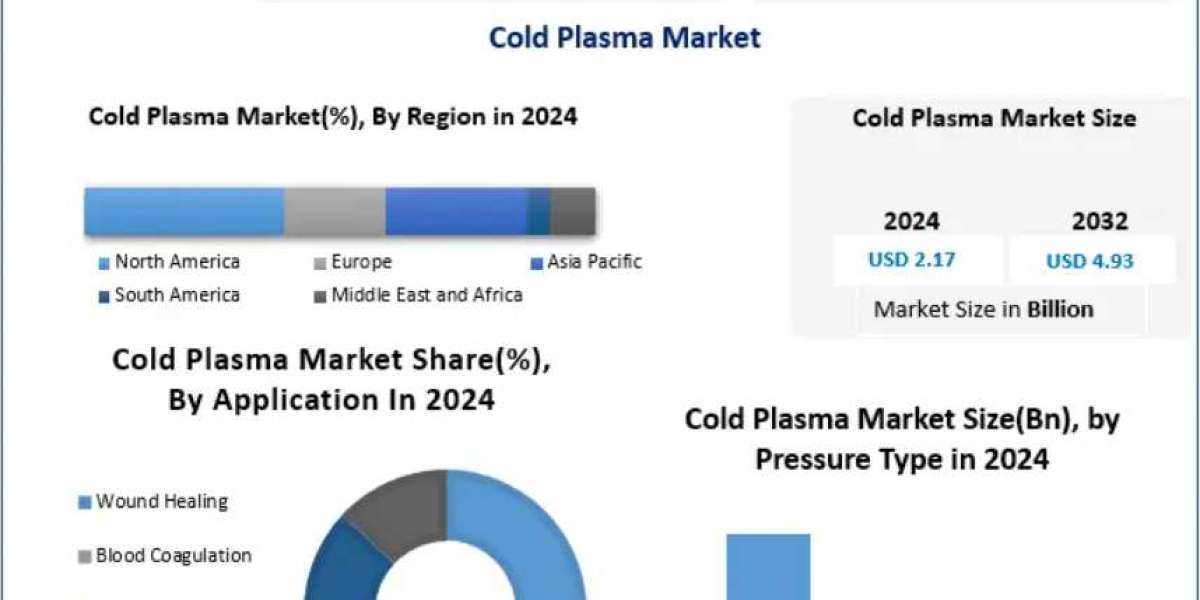

The Global Cold Plasma Market was valued at USD 2.17 billion in 2024 and is projected to expand at a CAGR of 10.8% from 2025 to 2032, reaching nearly USD 4.93 billion by 2032.

Cold plasma, also known as non-thermal plasma, has emerged as a transformative technology with applications spanning healthcare, packaging, textiles, electronics, and food processing. Unlike conventional plasma processes that require high thermal input, cold plasma enables sterilization, decontamination, surface activation, and therapeutic medical applications without damaging sensitive materials.

Over the past decade, the technology has evolved from industrial surface treatment systems to advanced medical devices, including those used for wound healing, cancer therapy, and dental applications. Its eco-friendly nature, low chemical dependency, and compatibility with modern sustainability goals further drive adoption across industries.

In healthcare, cold plasma technology is witnessing rapid uptake in advanced wound care and infection control. Devices such as Apyx Medical’s Renuvion and cold atmospheric plasma systems by CINOGY Technologies are paving the way for non-invasive medical therapies. At the same time, industrial solutions from Plasmatreat, Nordson, and Tantec are transforming packaging and electronics manufacturing by reducing chemical reliance and enhancing material adhesion.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/55315/

Market Dynamics

Key Growth Drivers

- Medical Advancements – Cold plasma offers painless, effective treatments for chronic wounds, burns, and infections, with growing clinical evidence supporting its use in oncology.

- Eco-Friendly Processing – Its ability to replace harsh chemicals, reduce water and energy consumption, and enable sustainable surface treatment drives adoption in packaging, textiles, and electronics.

- Rising Chronic Conditions – Increasing cases of diabetes, cancer, and hospital-acquired infections (HAIs) are fueling demand for innovative, non-invasive medical technologies.

Market Restraints

- High Initial Costs – Installation and maintenance of plasma systems are capital-intensive, limiting adoption among small and mid-sized enterprises.

- Limited Awareness – Many developing markets remain unaware of cold plasma’s advantages, slowing commercialization.

- Complex Operation – Precise control over plasma parameters requires trained personnel and advanced infrastructure.

Opportunities

- Oncology Applications – Early clinical trials highlight cold plasma’s potential in selectively targeting cancer cells while sparing healthy tissue.

- Infection Control – Post-COVID-19, hospitals are investing in plasma-based sterilization systems for instruments, surfaces, and even air purification.

- Integration with Smart Systems – Combining cold plasma with AI, robotics, and real-time sensors will expand its use in personalized medical care and automated manufacturing.

Segment Analysis

By Pressure Type

- Atmospheric Pressure Cold Plasma – Dominated the market in 2024 due to its cost-effectiveness and ease of integration. Its ability to operate without expensive vacuum chambers makes it suitable for large-scale industrial applications (packaging, textiles, electronics) and on-site medical treatments (wound care, sterilization).

- Low-Pressure Cold Plasma – Preferred for high-precision treatments in semiconductors and specialty electronics, though adoption is limited by high infrastructure costs.

By Application

- Wound Healing – Largest segment in 2024, supported by rising prevalence of diabetic ulcers, burns, and trauma injuries. Cold plasma accelerates tissue regeneration and lowers microbial load.

- Dentistry & Blood Coagulation – Growing use in surgical and dental procedures.

- Cancer Treatment – Emerging as a breakthrough segment with promising clinical trial results.

- Other Uses – Include sterilization, dermatology, and veterinary medicine.

By End User

- Medical Industry – Fastest-growing end-user segment, driven by demand for non-invasive treatments.

- Textile & Packaging – Widespread use for sterilization, decontamination, and surface activation.

- Electronics Industry – Adoption in printed circuit boards and semiconductors due to enhanced adhesion properties.

- Food & Agriculture – Cold plasma applied in food decontamination and packaging sterilization, particularly in meat and poultry.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/55315/

Regional Insights

- North America – Held the dominant share in 2024, supported by advanced healthcare infrastructure, strong FDA approvals, and high prevalence of cancer and chronic wounds.

- Europe – A hub for cold plasma innovation, with Germany, France, and the UK leading R&D in wound healing and oncology. EU’s sustainability goals further support adoption in packaging and food safety.

- Asia Pacific – Expected to grow at the fastest CAGR, driven by industrial expansion in China, Japan, and India and rising healthcare adoption across emerging economies.

- South America – Growing focus on healthcare modernization and food safety regulations in Brazil and Argentina.

- Middle East & Africa – Early adoption phase, but investments in infection control and agriculture open long-term opportunities.

Competitive Landscape

The cold plasma market is highly competitive with global players leveraging technological innovation, regulatory approvals, and application-specific expertise.

Key Players – North America

- Apyx Medical Corporation (US) – Strong presence in surgical applications with its FDA-cleared Renuvion device.

- Nordson Corporation (US) – Leader in atmospheric plasma systems for packaging, automotive, and electronics.

- Enercon Industries (US)

- Surfx Technologies (US)

- US Medical Innovations (US)

Key Players – Europe

- Plasmatreat GmbH (Germany) – Pioneer in industrial plasma systems.

- Relyon Plasma GmbH (Germany) – Focus on medical cold plasma innovations.

- CINOGY Technologies GmbH (Germany) – Specialized in wound care solutions.

- Henniker Plasma (UK)

- Tantec A/S (Denmark)

Key Players – Asia Pacific

- Adtec Plasma Technology Co. Ltd (Japan) – Strong focus on plasma medicine.

- PlasmaLeap Technologies (Australia) – Expanding presence in industrial applications.

Recent Developments

- July 2025 – Apyx Medical launched Renuvion in China, strengthening its footprint in the Asia-Pacific medical aesthetics market.

- Jan 2025 – Plasmatreat GmbH introduced PFW10LT & PFW100 Openair-Plasma nozzles, enabling precision treatment of sensitive materials and large-scale processing.

- Dec 2024 – Relyon Plasma partnered with Viromed Medical GmbH to advance plasma-based solutions for infection control.

Conclusion

The Global Cold Plasma Market is on a trajectory of rapid growth, driven by its ability to deliver eco-friendly, safe, and innovative solutions across medical and industrial sectors. While commercialization challenges remain in developing economies, expanding awareness, cost-effective systems, and integration with advanced technologies will position cold plasma as a core enabler of sustainable healthcare and industrial innovation by 2032.