The Money Transfer Agencies Market Trends are showing rapid growth as global remittances and cross-border transactions continue to expand. With increasing international migration and the rising demand for fast, secure, and cost-effective money transfer services, agencies are innovating to meet customer needs. Leading players, including western union, are shaping the Money Transfer Agencies Market through advanced digital solutions and strategic expansion.

Key Drivers Impacting the Money Transfer Agencies Market

The market is witnessing significant growth driven by technological adoption, evolving consumer preferences, and global economic trends. Agencies are increasingly integrating Payment as a Service Market solutions to enable faster, safer, and more reliable transactions. Real-time processing, mobile payments, and cloud-based platforms are revolutionizing traditional money transfer services.

Additionally, enhancements in operational efficiency and strategic collaborations are boosting the Money Transfer Agencies Market Trends. Automation and digital onboarding are enabling agencies to expand their customer base while reducing costs and enhancing customer satisfaction.

Regional Insights and Market Opportunities

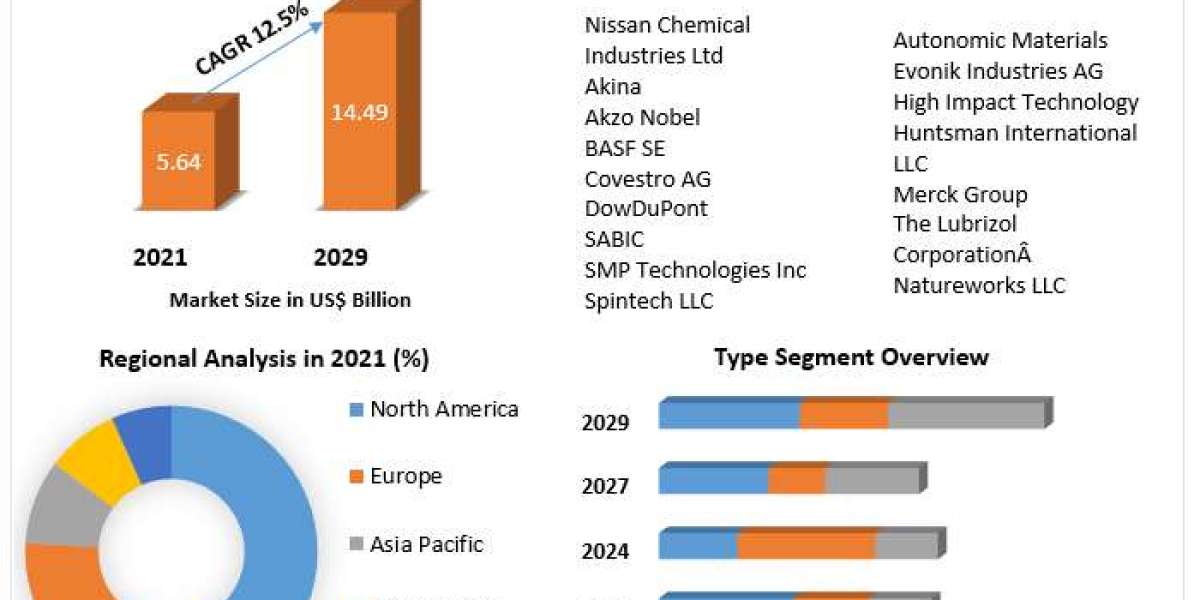

In Europe, the UK Account Payable Market is influencing money transfer agencies by streamlining financial operations for businesses and enabling secure payment processing. North America, Asia-Pacific, and Africa are experiencing rising demand for international remittances, presenting lucrative growth opportunities for agencies offering innovative solutions.

The use of digital wallets, mobile apps, and real-time settlement systems is further driving Money Transfer Agencies Market Development, ensuring seamless and efficient cross-border transfers.

Emerging Trends to Watch

Digital Transformation: Adoption of cloud-based and AI-driven platforms for secure and faster transactions.

Personalized Services: Tailored solutions for corporate clients, expatriates, and individual users.

Real-Time Settlements: Increasing demand for instant and frictionless cross-border payments.

Strategic Collaborations: Partnerships with fintech firms, banks, and payment service providers to expand market reach.

Conclusion

The Money Transfer Agencies Market is evolving rapidly, driven by digital transformation, customer-centric innovation, and globalization. Agencies that leverage Payment as a Service Market technologies and focus on operational efficiency in markets like the UK Account Payable Market are positioned to thrive in this competitive landscape. Established players such as western union continue to lead by combining trust, speed, and technology-driven solutions to meet the growing global demand.

FAQs

Q1: What factors are driving the growth of money transfer agencies?

Growth is fueled by increasing international remittances, technological adoption, mobile payments, and the rising need for secure and cost-effective money transfers.

Q2: How does Payment as a Service influence money transfer agencies?

It enables faster, safer, and more efficient transactions, integrating cloud-based platforms and real-time processing into traditional money transfer services.

Q3: Which regions are showing the highest demand for money transfer services?

North America, Asia-Pacific, and Africa are key growth regions due to rising international migration, remittances, and digital adoption.