Not long ago, many investors hesitated to put their money into the stock market. But things have changed!

Today, equity mutual funds have emerged as the king's choice for retail investors. Even when markets swing, people continue to stay invested because they are looking at the bigger picture. If you are hesitant about the options, ACE Financial Services, which is one of the best wealth management services in Kolkata, can help you combine the safety of planning with the growth potential of investments like equity mutual funds.

(Don’t use the second line written in this image)

Why Equity Mutual Funds are Growing Fast?

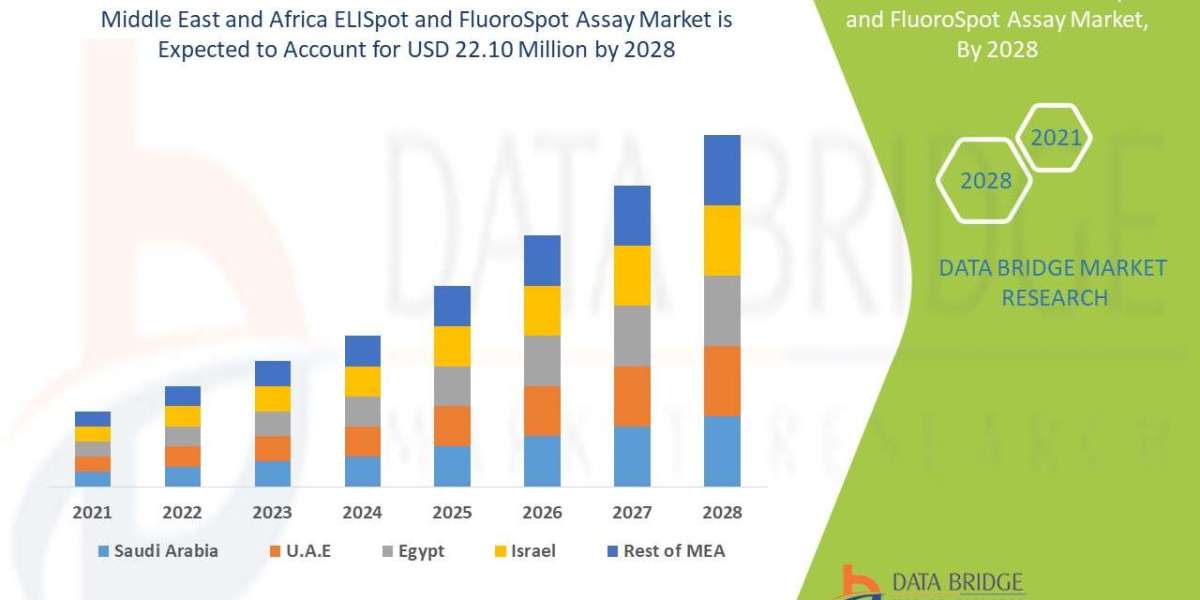

Equity mutual funds have gained huge popularity in recent years. According to Livemint, equity mutual funds saw their assets grow by 335% in just five years, reaching ₹33.32 lakh crore in July 2025. That’s a massive jump from ₹7.65 lakh crore in 2020.

The biggest driver has been Systematic Investment Plans (SIPs). By investing a fixed amount every month, investors have managed to reduce the impact of market ups and downs. With SIPs, you don’t have to worry about timing the market. Over time, this regular habit builds discipline and helps you achieve your financial goals.

For beginners who are just starting their investment journey, wealth management companies in Kolkata can play an important role. From helping you complete your KYC, guiding you through onboarding, and even placing your first SIP order, they can make the entire process smooth.

Why Equity Funds Matter in Wealth Management?

Equity mutual funds fit in perfectly because:

They have the potential to grow wealth faster than traditional savings options in the long term.

They allow diversification across companies and sectors.

SIPs make it easier to invest regularly without overthinking market volatility.

Over the long term, they have outperformed fixed deposits and savings accounts.

The Role of SIPs in Building Discipline

Many investors panic when markets fall.

SIPs reduce this fear. When the market is down, you buy more units. When is up, you buy fewer. This method, called rupee-cost averaging, helps smooth the journey.

Best part? They don’t require large sums. Even small amounts can create meaningful corpus if invested consistently over time.

Myths About Equity Mutual Funds

Equity funds are powerful tools, but many myths stop people from investing:

“They are too risky.” – Risk is there, but staying invested for the long term reduces it.

“You need a lot of money.” – SIPs allow you to start with small amounts.

“Returns are guaranteed.” – Returns depend on the market, but patience usually pays off.

“Better to stick to fixed deposits.” – Fixed deposits are safer but give lower growth; equity funds add balance.

How Wealth Managers Help with Equity Mutual Funds

Equity funds alone won’t solve everything. You need to know how much to invest, when to review, and how to align them with your financial goals. This is where professional wealth managers make a difference. They:

Assess your goals – like retirement, buying a house, or children’s education.

Help you invest in the funds – managers set up your accounts and help you invest.

Review portfolios – to make sure investments stay on track.

Control emotions – not letting you panic during market drops.

Wealth management adds structure, while equity mutual funds provide growth potential.

The Variety in Equity Mutual Funds

Equity funds are not one-size-fits-all. There are:

Large-cap funds – safer, invest in big companies.

Mid-cap and small-cap funds – higher growth, but riskier.

Flexi-cap funds – a flexible mix of large, mid, and small companies.

Sectoral and thematic funds – focus on specific industries.

Common Mistakes Beginner Investors Should Avoid

Investing only for the short term – Equity funds need patience.

Chasing past returns – A fund that did well last year may not always perform.

Ignoring diversification – Putting all money into one fund increases risk.

Stopping SIPs during downturns – This often reduces long-term potential for corpus creation.

Not reviewing regularly – Plans need updates as your life changes.

Number of Equity Funds

Livemint reports that inflows into equity mutual funds jumped from an outflow of ₹3,845 crore in July 2020 to an inflow of ₹42,673 crore in July 2025. This shows growing trust among retail investors.

Interestingly, sectoral and thematic funds saw the highest inflows. This reflects the curiosity for new opportunities. But wealth managers often caution against putting all money in these because they can be volatile. Instead, a balanced approach works better.

Conclusion:

Wealth management is about building financial security step by step. Equity mutual funds can be a great tool to make this happen because they combine potential growth with flexibility.